Introduction

Nowadays, customer expectations have been at an all-time high in every sector, including Banking. And in such a time, artificial intelligence (AI) is proving to be a great ally. AI is no longer a visionary concept; from voice-driven assistants to hyper-personalized financial insights, it is reforming customer conversation, loyalty, and decision making

According to the Ideal Team Group’s report on The Top 5 Trends in the UK Financial Services Industry the UK Financial Services sector is anticipated to grow at a 12.24% CAGR, attaining a market volume of $127.3 million by 2029.

Major financial institutions are adopting AI, and it’s not just making the experience exceptional, but it’s also reshaping features like personalization and empathy in the financial sector. Whether it’s maintaining compliance, detecting fraud, replying to queries like a real person, or giving bespoke saving tips as per your lifestyle, AI has been offering the UK financial sector a decisive edge in the highly regulated and competitive industry.

1. Conversational & Agentic AI: From Chatbots to Co‑Taskers

Script-based chatbots and robotic conversations are things of the past. At present, conversational AI is deployed by UK banks that carry on conversations like humans. Whether it’s simply helping the customer with a loan application or dealing with complex queries. However, the most significant stride has been the agentic AI. These smart systems collaborate with the agents and act as co-taskers.

According to a Gartner’s report Agentic AI Set to Transform Customer Service & Support Landscape, Reshaping Inbound Interactions and Forcing Service Teams to Embrace Automation– By 2029, 80% of general customer issues will be resolved by Agentic AI.

These co-tasking Agentic AI analyse customer conversations in advance while interpreting their tone and urgency. A smart resolution is suggested before the issue is escalated to a human agent.

As per the data in the Finextra article AI Becomes the Banker: 21 Case Studies Transforming Digital Banking CX- NatWest a UK banking group, positioned AI at the core of its customer experience strategy and collaborated with open AI “Cora,”. NatWest reported that with the implementation of Cora, customer satisfaction scores were boosted by 150% and there was a significant decrease in human intervention.

2. Hyper‑Personalization & Predictive Insight

Nowadays, the systems constantly analyse customer insights to offer a tailored, real-time experience. Similarly, the banking sector in the UK has stepped up from basic automation to behaviour-driven intelligence.

For example, a bank could offer a custom credit card with e-commerce offers to a customer who is a frequent online shopper.

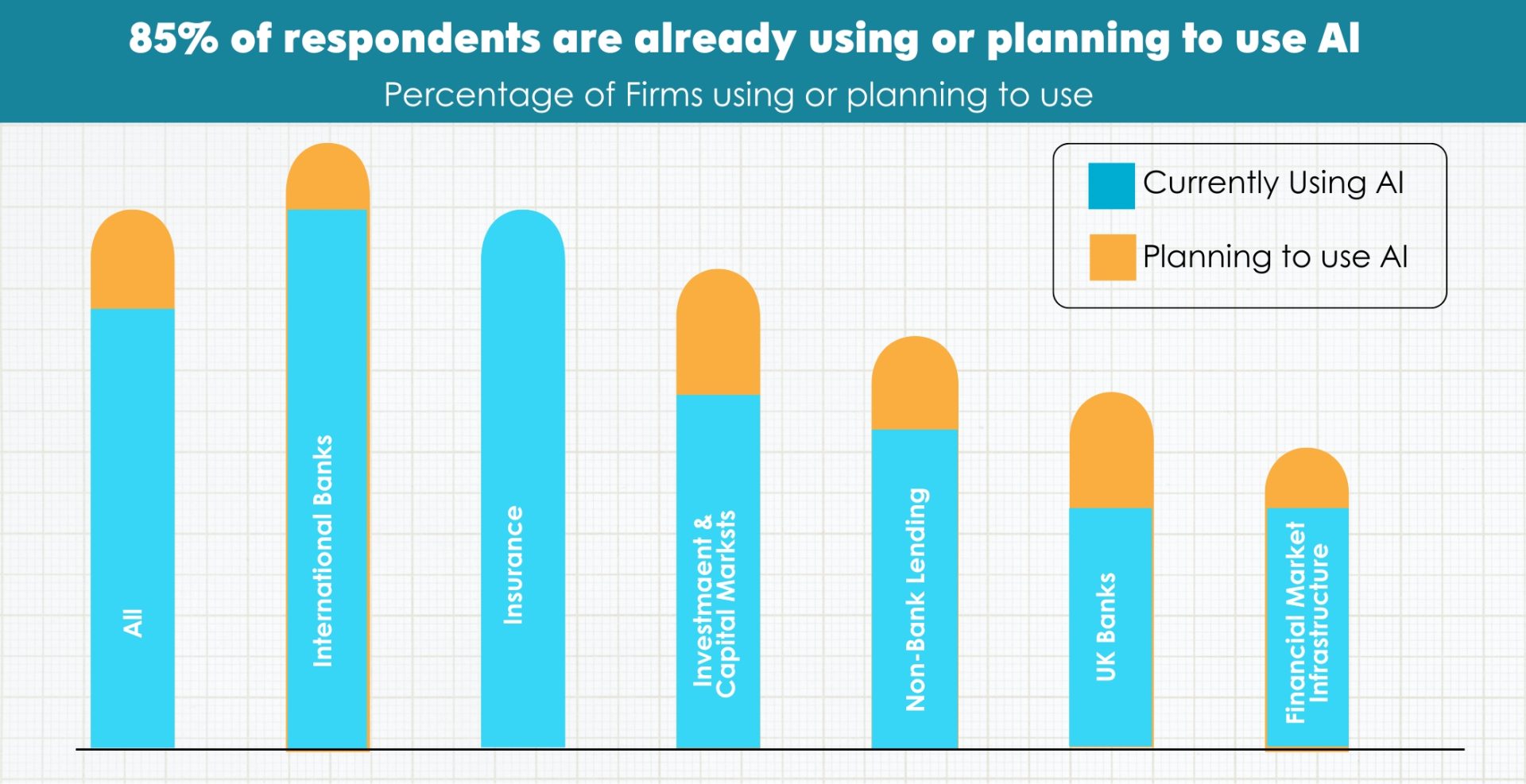

As per a report of a Survey conducted by the Bank of England, Artificial intelligence in UK financial services – 2024, 75% of financial firms in the UK are already using artificial intelligence (AI). Also, further 10% are planning to use AI over the next three years.

3. Voice-First & Emotional AI: Banking That Listens-and Feels

We have officially arrived in the period of voice-first. Users speak to AI assistants, and they respond with the correct tone and context. Imagine –”As per my earnings this month, how much should I spend, and receive a prompt spoken breakdown furnished with data.

However, there’s more that the future holds, emotional AI, which can detect mood, tone, and even stress level, it’s a breakthrough for customer satisfaction

As per McKinsey’s article- The economic potential of generative AI: The next productivity frontier – The full implementation of generative AI could add $200 billion to $340 billion annually, i.e., 2.8 to 4.7 percent of total industry revenues, by enhancing productivity.

4. Real-Time Fraud Detection & Trust-Building

Security is considered the most critical factor in data collection by 94% of consumers in the UK financial sector.

AI-powered fraud detection systems are becoming saviours for UK banks in an age where cyber criminals are becoming advanced and cyber threats are rampant. Suspicious behaviour is flagged before the mishap.

- AI could detect irregularities in expenditure patterns.

- Identity discrepancies could be flagged

- Minute behavioural biometrics, like typing speed or device tilt, are monitored

5. Omnichannel & Immersive Experiences

Customers today expect a journey that is seamless across all communication channels like mobile apps, websites, and voice assistants. Those days are not ahead when we can visit a virtual bank branch via VR, communicate with an avatar advisor, discuss our home loan plans, or tell our smart speaker to increase the savings amount by 15% from this month, and the banking app promptly amends all your expenses in every category.

Conclusion: A New Era of Banking Begins

AI is here, and it is no longer a visionary idea. It’s reshaping the communication style of UK banks with their customers. Customer experience is getting transformed with speed, efficiency, and precision via bespoke financial advice, 24/7 virtual assistants, and vigilant fraud detection. But this is not the end of the AI revolution.

Deploying AI is not just limited to being ahead of competitors; for banks in the UK, it sets new benchmarks in trust, convenience, and innovation. With growing customer expectations, banks adopting AI in their functions are setting the road ahead for the next generation of banking that does not involve just capitalizing on the technology but also building deeper, more human connections.

Looking to dive deeper into how How AI Is Transforming Customer Engagement and Operations in UK Financial Services? Explore these related articles that complement How AI Is Transforming Customer Engagement and Operations in UK Financial Services

Frequently Asked Questions About AI in UK Banking

1. Is AI being extensively adopted by banks in the UK?

Indeed! Major UK banks like Barclays, Lloyds, and NatWest are embracing AI to streamline onboarding, enhance customer support, and improve satisfaction across all communication channels.

2. What does the future hold for AI in customer experience in the UK banking sector?

Future trends include:

- Emotion-aware AI for empathetic banking

- Tailored banking journeys

- AI-enabled financial wellness tools

- Real-time multilingual support

These advancements aim to further personalize and improve customer interactions.

3. What is agentic AI, and how does it enhance customer service?

Agentic AI collaborates with human agents as co-taskers. It analyzes customer conversations, interprets tone and urgency, and suggests smart resolutions before issues are escalated to human agents. This collaboration boosts efficiency and customer satisfaction.

4. How does AI contribute to hyper-personalization in banking?

AI systems analyze customer behavior and preferences to offer tailored experiences. For instance, a bank might offer a custom credit card with e-commerce offers to a customer who frequently shops online, enhancing relevance and engagement.

5. What role does emotional AI play in customer interactions?

Emotional AI detects mood, tone, and stress levels in customer interactions. This capability allows banks to respond with appropriate empathy and support, creating more human-like and compassionate customer experiences.

Sources :

the Ideal Team Group’s report on The Top 5 Trends in the UK Financial Services Industry

Agentic AI Set to Transform Customer Service & Support Landscape, Reshaping Inbound Interactions and Forcing Service Teams to Embrace Automation

AI Becomes the Banker: 21 Case Studies Transforming Digital Banking CX

The Bank of England, Artificial intelligence in UK financial services – 2024