Introduction:

Insurance companies are using conversational analytics to improve customer experience (CX), expedite claims, and create a personalized service. As expectations continue to increase and more businesses go digital, data to inform customer interactions is emerging as the critical factor in CX success and retention.

Conversational Analytics in Insurance: The Big Picture

The world is in the midst of a data revolution, and the insurance industry is no exception. By leveraging the immense Power of Conversational Analytics, insurance companies can significantly enhance their customer experience (CX), driving customer satisfaction, retention, and overall profitability.

Understanding Conversational Analytics

Conversational analytics leverages artificial intelligence (AI) to analyze customer interactions across diverse channels, such as social media, call center conversations, email communications, and chatbots. Assessing sentiments, language usage, and interaction patterns offers invaluable insights into customer behavior and preferences, allowing insurance companies to improve their services.

As per Gartner’s report, Three Technologies That Will Transform Customer Service and Support By 2028, around 80% of customer service and support organizations are anticipated to embrace generative AI to boost agent productivity and customer experience by 2025

How Conversational Analytics Can Be Beneficial for the Insurance Industry

Intricate approaches and paperwork typically characterize the insurance industry. However, conversational analytics can greatly benefit the insurance industry. Let’s understand how:

Tailored Customer Interaction

With conversational analytics, insurance companies can understand customers on a granular level, tailoring services to individual needs. For instance, based on a customer’s interaction history, an AI-driven chatbot can recommend the most relevant insurance plans.

As per FintechMagazine’s article-Banking customers ‘want more personalised financial advice‘- Now 70% of customers want banks to offer personalized experiences

Predictive Analysis

Insurance providers can predict future customer behaviour and trends by analysing past conversations, aiding in risk assessment and policy pricing.

According to a Gartner’s report Agentic AI Set to Transform Customer Service & Support Landscape, Reshaping Inbound Interactions and Forcing Service Teams to Embrace Automation- By 2029, 80% of general customer issues will be resolved by Agentic AI.

These co-tasking Agentic AI analyse customer conversations in advance while interpreting their tone and urgency. A smart resolution is suggested before the issue is escalated to a human agent

Business Intelligence & Analytics Services

Effective Claim Management

Conversational analytics can streamline the claim process by identifying common issues from past interactions, thus offering faster and more efficient service.

Improved Customer Retention

According to The Times’ article “First Direct: Inside the Firm That Gets Customer Service Right,” about 32% of customers switched banks, primarily due to better customer service

Since acquiring a new customer’s six to seven times more expensive than retaining an existing one, customer retention is a crucial focus for insurance companies. Conversational analytics enables companies to gauge customer sentiment and dissatisfaction, allowing timely intervention.

According to a Capgemini survey report, over 50% of customers use three or more channels to research and buy insurance coverage

The Way Forward for Insurers

As we move towards an increasingly digital future, insurance companies that leverage conversational analytics will have a competitive edge. They can significantly enhance their CX by offering personalized, efficient, and proactive services, which foster customer loyalty and drive business growth. In order to benefit from conversational analytics, Insurance companies now need to invest in technologies that promote a culture driven by data.

In conclusion, data analytics is the future of the insurance sector’s success, and conversational analytics is a vital piece. By deploying technology like Speech Analytics and a strong QMS, insurance providers can unlock a new level of customer experience, leading the way in the industry’s digital transformation.

Reach out to us to know how Bill Gosling can help you achieve your Customer Experience improvement goals!

Frequently Asked Questions About Conversational Analytics in Insurance CX

1. What is conversational analytics?

Conversational analytics uses AI to analyze customer interactions across channels like calls, emails, chatbots, and social media. It examines sentiment, language, and interaction patterns to gain insights into customer behaviour and preferences.

2. How can conversational analytics improve claim management?

By identifying common issues and bottlenecks from past conversations, insurers can streamline claims processes. This leads to faster responses, reduced processing time, and enhanced efficiency.

3. How does it help with personalized customer interaction?

Insights from conversational data help insurers tailor interactions. For example, chatbots or agents can use customers’ interaction histories to offer relevant insurance plans or guide decisions suited to their needs.

4. What role does predictive analysis play?

Predictive analysis forecasts customer behavior and trends by examining past interactions. This aids in risk assessment, optimizing policy pricing, and proactively addressing customer needs.

5. Can conversational analytics boost customer retention?

Yes. It allows companies to monitor customer sentiment and detect dissatisfaction early. Timely intervention can improve satisfaction, reduce churn, and foster loyalty.

6. What investments are needed to leverage conversational analytics effectively?

Investments include: latest analytics tools, speech/text analysis capabilities, a solid quality management system, training staff in data-driven decision making, and adopting a culture that values continuous feedback and improvement.

Sources :

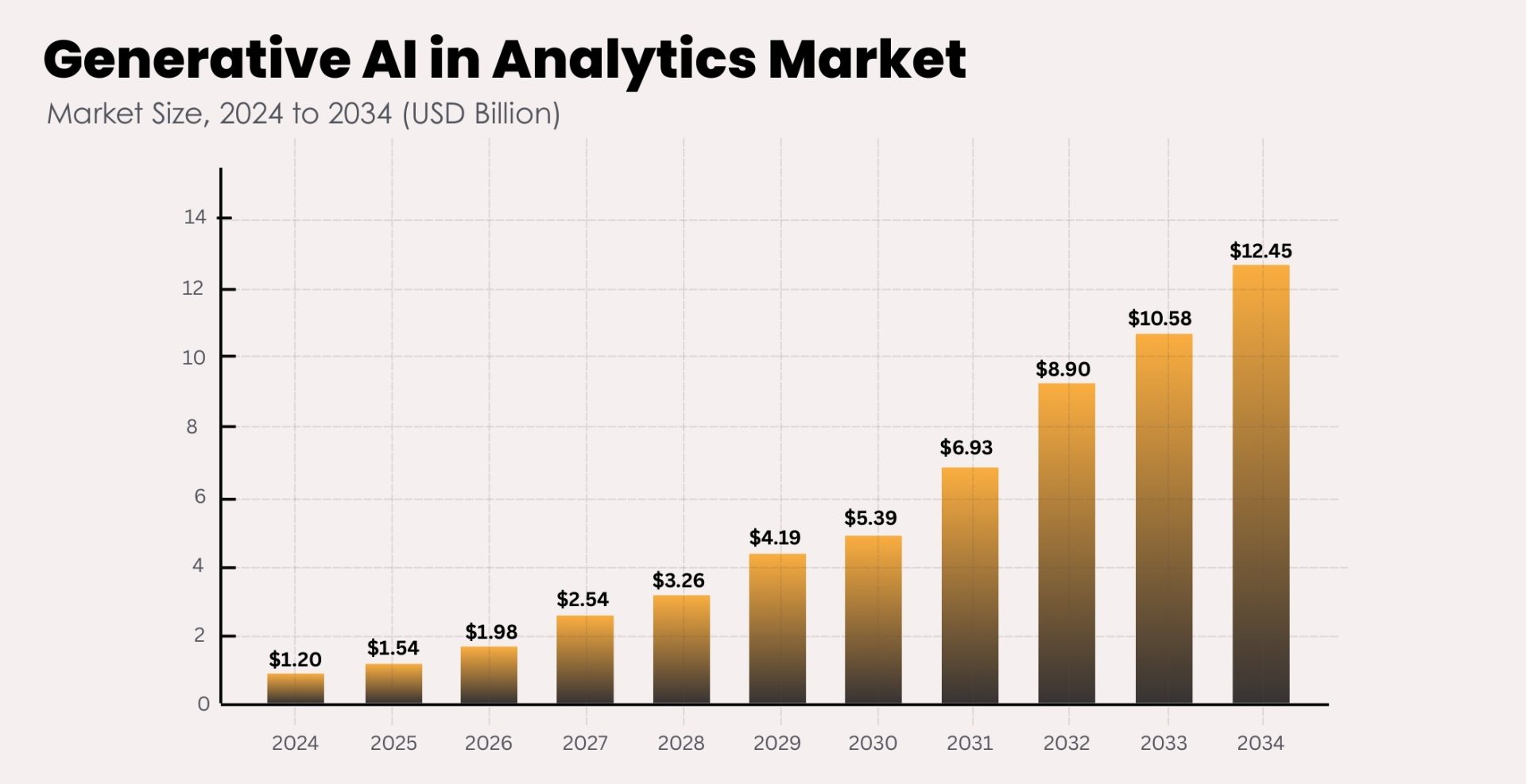

Generative AI in Analytics Market Size, Share, and Trends 2025 to 2034

Gartner reveals Three Technologies That Will Transform Customer Service and Support By 2028

Banking customers ‘want more personalised financial advice

Agentic AI Set to Transform Customer Service & Support Landscape, Reshaping Inbound Interactions and Forcing Service Teams to Embrace Automation

First Direct: inside the firm that gets customer service right

Inventive insurer strategy: Seamless omnichannel engagement with digital and emotional connection