Credit unions are grabbing the attention at times when big banks are losing customers’ trust and loyalty. These member-owned institutions are gaining momentum by blending customer-centric approaches, digital renovation, competitive rates and the community’s loyalty and trust. As you will read ahead, membership has steadily increased due to the deployment of enhanced technology, reliability, and focus on consumers. Credit unions are developing as consequential entities in the financial sector.

In March 2024 there were 4,571 credit unions in the US as per the National Credit Union Administration (NCUA).

According to the National Credit Union Administration Quarterly Credit Union Data summary Q2 2024 as of June 2024, there were an estimated 141 million members in credit unions.

As per the latest data by the National Credit Union Administration, in Q4 of 2024, the total assets in federally insured credit unions grew by 3%, i.e. by $52 billion.

The total loans outstanding in Q4 increased by 2.6% to $42 billion, totalling $1.65 trillion.

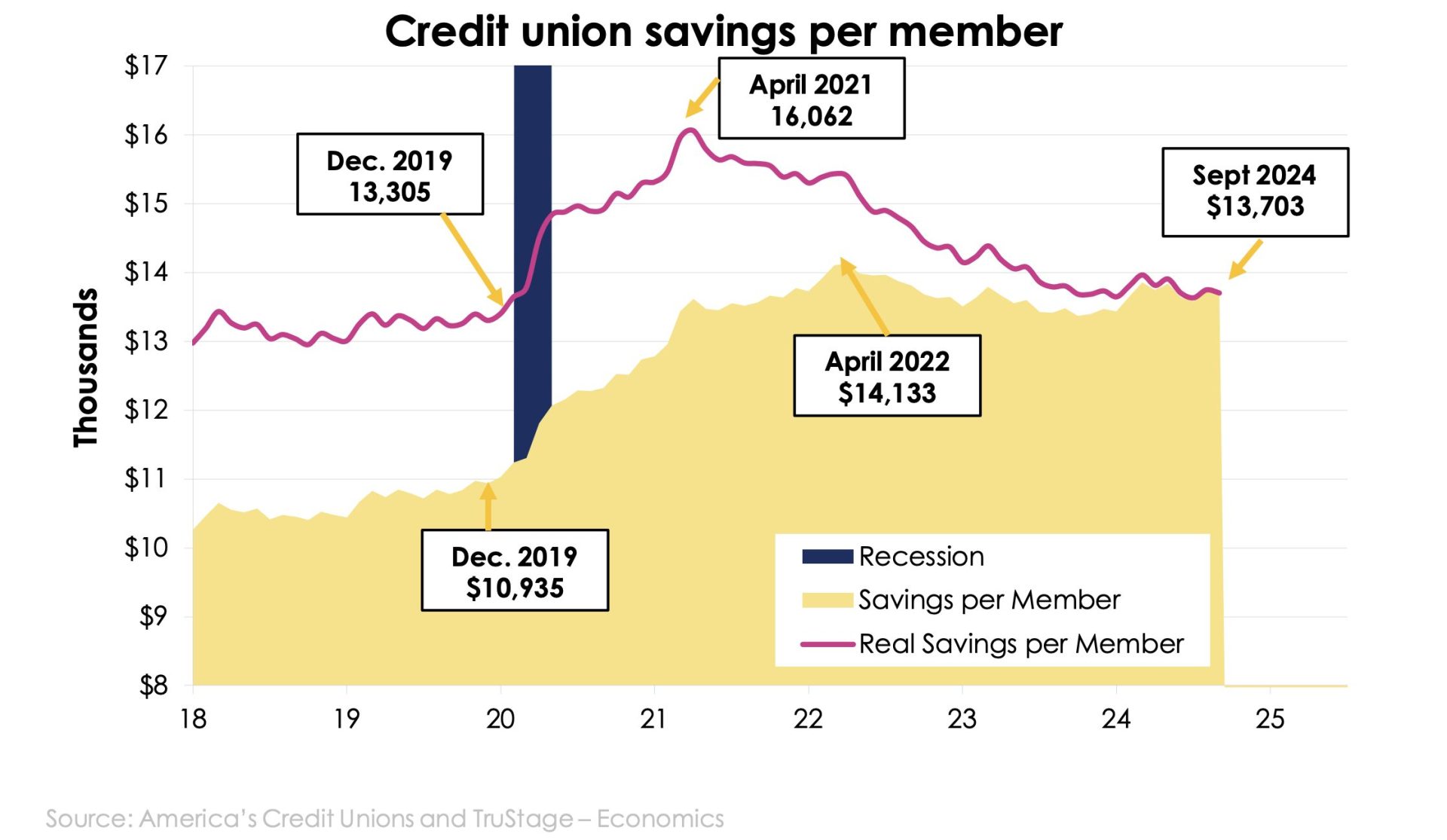

In Q4 of 2024, the total shares and deposits grew by $78.2 billion, or 4.2%, over the year to $1.96 trillion.

- In Q3 2024, the delinquency rate for federally insured credit unions was 91 basis points.

The data mentioned above are clear evidence of the emergence of Credit unions as a strong contender in the financial services sector. With an increasing membership base, digital transformation, and the objective of putting people over profits, these community-based institutions focus on what consumers anticipate, i.e. empathy, trust and transparency. Credit unions nurture deeper and more personal relationships, which is generally absent in traditional banks. These institutions are moving in the right direction by implanting AI-driven CX and developing fintech partnerships. Credit unions are changing their role from an alternative to a first choice.

Sources:

Biggest U.S. Credit Unions by Asset Size – MX

NCUA Quarterly Credit Union Data Summary – Q2 2024

Q4 2025: Credit Union Assets, Delinquencies, Shares & Deposits – NCUA

Top Investment Priorities of Credit Unions in 2025 – Alkami

Credit Union Loans, Assets & Delinquencies Rise; Net Income Down – NCUA 2024

Credit Union Trends Report – TruStage (2024)