Introduction

Auto financing for many years has been considered a jargon-filled process loaded with paperwork, and it was also the least exciting part of purchasing a car. However, major transformation is being experienced by the auto finance industry with the advent of the digital economy. Today, the basic requirements of customers include convenience, quickness, and personalization. And as a result, Customer Experience has become the new differentiator to achieve loyalty and trust.

Mind morsel

As per Precedence Research article Automotive Finance Market Size, Share, and Trends 2025 to 2034– in 2025 the global automotive finance market size stood at USD 320.67 billion. This sector is anticipated to reach USD 548.17 billion by 2034 increasing at a CAGR of 6.38%[i].

Mind Morsel

As per Consumer Federation of America’s report-Driven to Default: ? The Economy-Wide Risks of Rising Auto Loan Delinquencies After mortgage auto loan is the largest category of consumer debt

Not test driving or choosing the perfect car colour, but for any car buyer, the biggest fear was the financing desk.

- Infinite paperwork

- Unclear interest rates

- Absence of transparency

- Lengthy wait times

With high expectations, customers today are in no mood to tolerate long waiting times. The best way to thrive in this sector is to create seamless, digitized, and human-centric experiences.

As per Trading Economics’ Research-United States Debt Balance, Auto Loans- In the second quarter of 2025, the Debt Balance in Auto Loans in the United States (US) was $1.66 Trillion

What’s leading to this movement?

1. Digital-First Expectations

Over generations, the demands of the population have considerably changed. A swift e-commerce-like experience is expected, especially by the Millennials and Gen Z crowd.

- Tailored loan recommendations

- Immediate credit assessments

- Mobile-friendly applications

- Real-time status updates

2. Transparency is the new equity

With ample of knowledge and awareness, customers don’t want to just pay, they also want to understand for what all they are paying for. Precisely, trust and loyalty can be established by the lenders who keep their terms and conditions clear also offer real-time calculators.

Innovations in Customer Experience

Personalization driven by AI

Hyper-personalized loan offers are made based on customer behaviour, and credit score. This is made possible through AI and machine learning. Strategic and efficient loan terms can be prepared with these tools.

Mind morsel

As per data provided by Lending Tree, In the first quarter of 2025, 5.1% of Americans with auto loans were delinquent

Mobile-First Financing

Like previously mentioned, customers want to meet on their preferred screen and time. Today, from applying for a loan to disbursal, everything can be done on the mobile. Some of the features exceptionally popular are:

- Uploading documents

- Pre-qualification in minutes

- Digital contracts

- E-signature

The new assistants- Chatbots

Financing queries can be handled 24/7 with chatbots. Managing customers and answering every question with natural language and prompt support to help them with complex decisions.

Wrap up

Aiming for the future- CX propelled Auto Finance.

We have smart cars today; thus, we also need to make our financing smart too. In the future, auto finance will not be limited to just lending money. It will be about establishing trust, lowering tension, and offering satisfaction at every touch point of the customer journey. The auto finance industry is at an intersection, and in an ecosystem where customer experience is the new battleground, lenders that will embrace the technology and innovation will thrive and succeed in the future.

Frequently Asked Questions on Customer Experience in Auto Finance

1. What’s the importance of customer experience in auto finance?

Customer experience in auto finance impacts customer loyalty and retention. Companies that offer tailored and smooth financing options appeal to customers and are preferred over others.

2. Is customer experience in auto financing impacted by technology?

The financing process is simplified and made easy with digital tools such as AI-driven chatbots, online submission of loan applications, uploading documents, digital contracts, and e-signatures. These tools decrease the waiting time and offer transparency and clarity of terms.

3. Do customers change lenders because of a bad experience?

Yes, there are various studies that have proved that today, customers don’t hesitate to switch financial providers if they face a lagging and inefficient experience.

4. Does tailored experience improve the auto finance journey?

Today, customers want to feel acknowledged and valued, and this can be done through personalised terms of loan, way of communication, and service choices. Personalization infuses trust in customers and makes the transaction warm.

Sources:

Automotive Finance Market Size, Share, and Trends 2025 to 2034

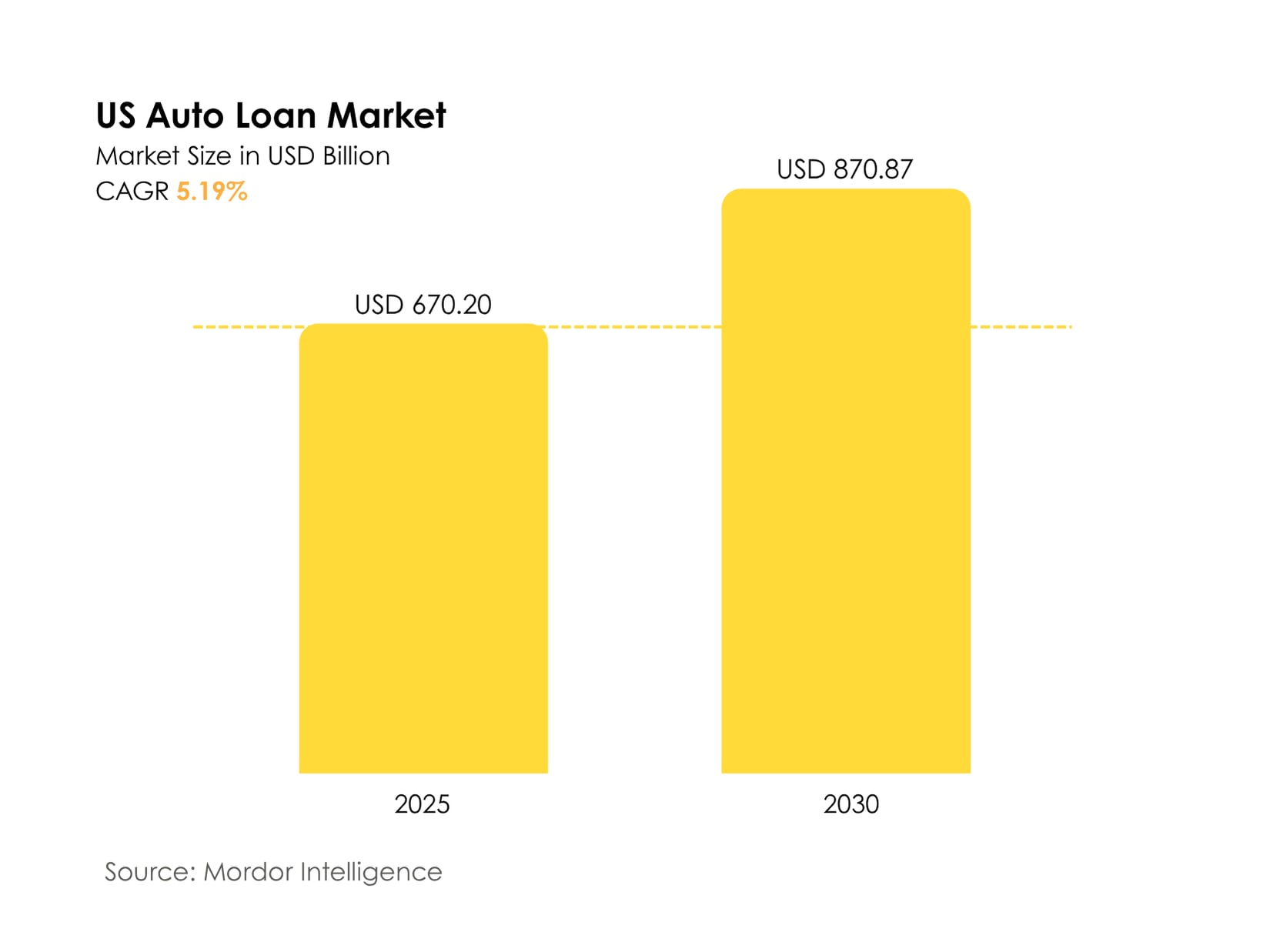

United States Auto Loan Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Driven to Default: ? The Economy-Wide Risks of Rising Auto Loan Delinquencies

United States Debt Balance, Auto Loans

5.1% of Americans With Auto Loans Are Delinquent; Gen Zers Hit Hardest