Introduction

In the business world, viable growth isn’t about just adding “more customers” or “introducing more products or services”. Spoiler alert: it’s none of the above.

The banking industry is a place where customers can switch banks with just a few clicks, and their loyalty lasts as long as they benefit from the banks’ offers and percentage rates. Today, dynamic banks are shifting their focus from having many customers to having valuable customers.

This is where “customer lifetime value” (CLV) comes in. In the US banking industry, CLV is no longer optional or an analytics exercise, but it has become a survival skill.

In this blog, we’ll break down how CLV shapes sustainable (“viable”) growth and how leaders can use CLV to improve acquisition, retention, pricing, and product strategy without chasing volume in the US banking dynamics.

1. Understanding customer lifetime value as a financial metric

CLV is the estimated net value or profits a business expects to earn from a customer during their entire relationship course. This includes revenue accounting, serving costs, operational risk, and retention value.

According to Start US Insights’ ‘Banking Industry Report 2025: Key Data & Innovation Insights’ article, the market value of the global banking industry stood at $29.8 trillion in 2025 and will grow at a CAGR of 7.35% to reach $52.56 trillion in 2033i

As per the Cognitive ‘Banking Industry Analysis 2026’ article, the US banking industry was valued at $3.35 trillion in 2025 with a market share of 9.7% ii.”

This metric isn’t about attractive sign-ups; it keeps an eye on which customers stay, grow, and deeply impact the business profitability.

In short, CLV includes analyzing:

- Revenue earned from a customer;

- Overhead cost to offer services and to acquire a customer;

- Retention cost and churn rate;

- How long does a customer stays.

McKinsey’s ‘Global Banking Annual Review 2025: Why precision, not heft, defines the future of banking’ article states that only 4% of the loyal customers are checking accountsiii.”

Breaking Down the CLV Formula for the Banks

CLV = (Average revenue per customer * Customer relationship length) – Overall Costs”

In the banking industry, CLV focuses on:

- Income through interest;

- Account and wealth fees;

- Cost to provide services;

- Risk involved and losses;

- Relationship period;

- Deposit economics.

Based on Coinlaw’s ‘Banking Customer Retention Statistics 2025: Global Rates, Digital Impact & Gen Z’ article, the average acquisition cost for a new customer in the US stood at $390 iv.”

2. Why does CLV matter in US banking?

In banking, CLV is crucial as:

- Relationships are basically longer than in the other industries (mortgages, deposits, wealth, business services, and more).

- Customer service costs are variable due to different channels, i.e., branch-heavy, digital preference, self-service, and priority service.

- Expectations and needs evolve based on the life stages of the customers, i.e., students, breadwinner, investor, and retiree.

- Different changes involve pictures (credit losses) and reduce revenue.

- Customers with multiple products and services stay with the business, whereas customers with a single product or service may leave.

3. Moving Beyond Growth At any Cost: A Study of Viable Growth

In the last few decades, various banks have understood the hard way that high acquisition cost may look like growth; however, it is a slow drain on total revenue.

Viable growth includes:

- Covering capital costs on its own;

- Ensuring profits even during stressful times, i.e., high charges, high funding, or more.

- Growth is not dependent on incentives, offers, and marketing spending.

- Improved growth without increased workload.

There is a difference between good and bad growth, i.e.,

- Good growth is where the cost to the customer is less than revenue growth;

- Bad growth is where customers leave after the offer period and incur high service costs.

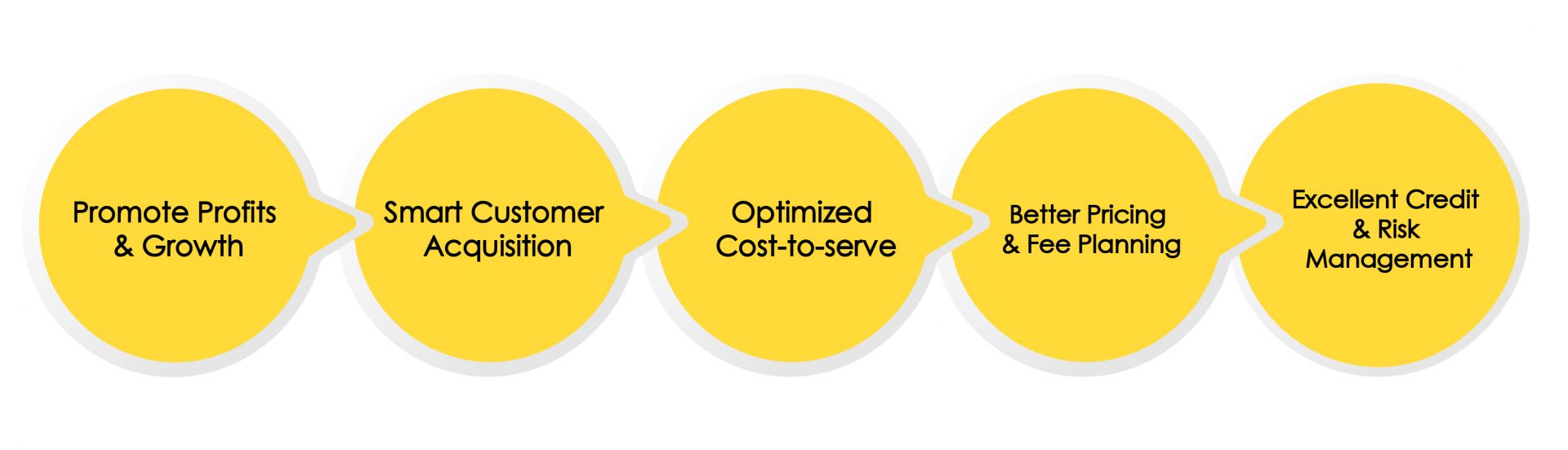

4. Benefits of Using CLV in the US Banking Industry

In the banking industry, competition is aggressive, margins are sensitive, and customer loyalty is fragile. The tree of CLV metrics can bear a lot of fruit to boost banking operations and revenue. Implementing CLV offers various benefits, such as:

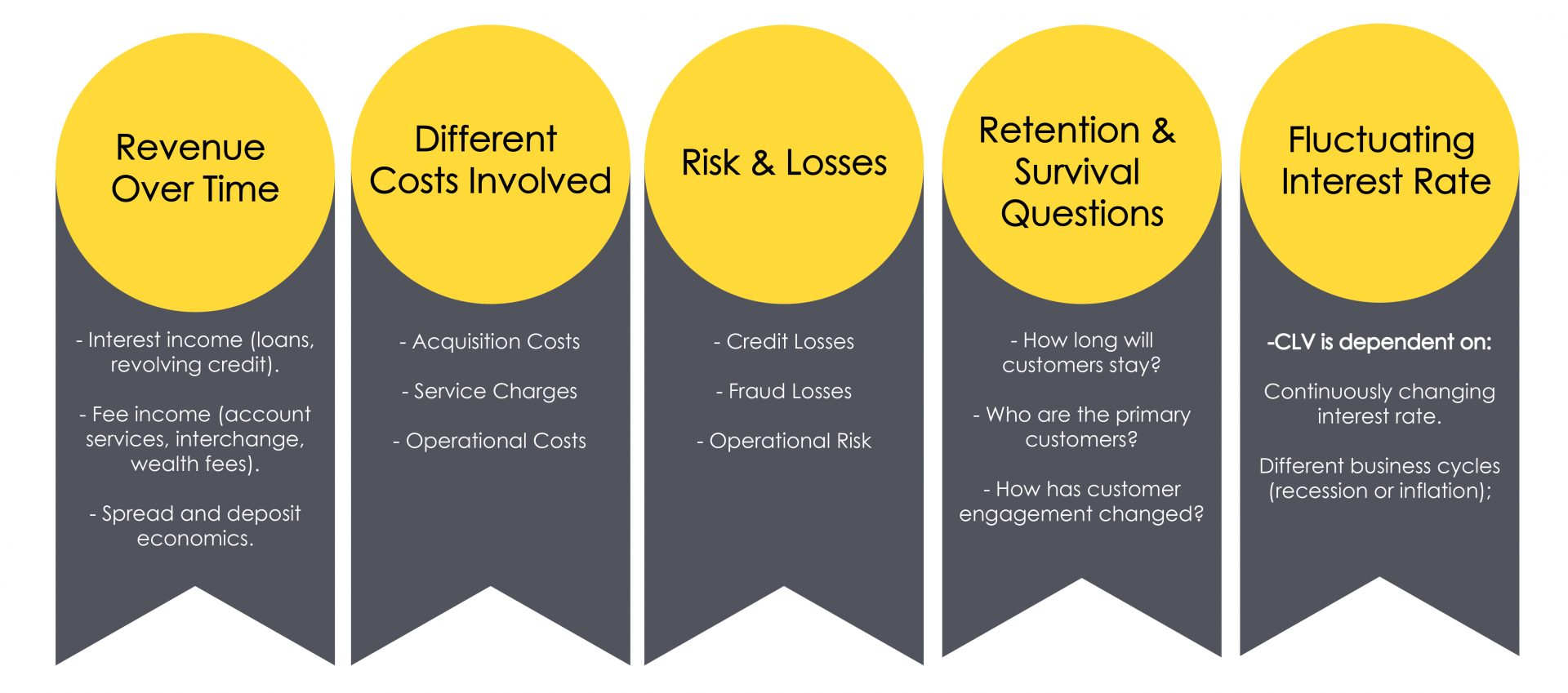

5. The CLV equation in banking: What actually affects it?

Knowing about a powerful metric like CLV isn’t sufficient; however, implementing such metrics makes it difficult and challenging. There are various factors that affect the US banking entities, such as:

6. CLV-driven Growth Strategy: What Should Banks Do Differently?

CLV isn’t about doing the right math, but it is about handling the uncertain factors that change with passing time. Banks that implement CLV effectively can lead the way towards sustainable growth and profitability. We’ve listed some of the best strategies that can be adopted by the banking entities to stay focused on the game.

Segment by “future value,” not just current balance

Two customers with the same checking balance may have different trajectories:

- One is early-career with rising income.

- One is stable but has low engagement and is price-sensitive.

CLV segmentation combines:

- behaviour (direct deposit, bill pay, digital engagement),

- life stage indicators,

- risk profile,

- product propensity.

“According to Capgemini’s ‘Financial Services Top Trends 2025- Retail Banking’ report, 45% of the US consumers prefer sorting their finances through mobile applications v.”

Align collections and retention strategies

Debt collection is an integral part of banking. However, when customers are asked for due payments, it may make the relationship sour. Calling for collections may recover the bank’s money, but it can affect the lifetime value. CLV-based collections help maintain the balance amongst debt recoveries, customer experience, and long-term customer relationships.

Use CLV to automate

Automation has also become essential for the banking industry. As CLV is impacted by numerous factors, automation prioritizes onboarding verification, fraud and dispute workflows, payment issues, card servicing, account changes, and servicing requests.

Accenture’s ‘Banking Consumer Study 2025’ report states that only 26% of the customers prefer giving data access to the bank’s AI in the name of personalized servicesvi.”

Treat service as a CLV investment

CLV can categorize high- and low-value customers to provide appropriate services. Banks must ensure that high-value customers, paying high premiums, get their issues resolved quickly, get instant alerts, and get better support. For low-value segments, banks must establish self-service portals like FAQs or chatbots so that cost-to-serve is controlled, issues are resolved easily, and customer experience is not influenced.

“As per Capgemini’s ‘Financial Services Top Trends 2025- Retail Banking’ report, 60% of the customers state the bank’s chatbot services as average v.”

Create onboarding journeys and not just completion

It takes a few months, i.e., about 1 to 3 months, to learn whether a customer is “primary” or not. With the implementation of CLV, banks ensure that customers quickly adapt:

- Direct deposit,

- Recurring bill payments,

- Savings habits,

- Card usage.

8. Metrics that Support Viable Growth with CLV

To ensure viable growth, banks must track CLV along with the following metrics:

- Payback period;

- Cost-to-serve per customer;

- CLV and acquisition cost;

- Churn rate;

- Net losses and fraud rates;

- Primary relationship indicators.

Final Words

In the US, banks cannot survive just by adding more customers. It is essential for the banks to focus on building long-lasting relationships and ensuring high-quality services to support profitability. This isn’t about winning the game just by gaining numbers; it is about finding the right relationship.

With the adoption of CLV, the US banks become smart, pricing becomes a strategy, services become a responsibility, and marketing becomes precise. This reduces leaks in the form of attrition, uncertain costs, and inefficiency, and promotes growth and profits.

CLV doesn’t ensure overnight miracles, as it is a long-term approach. The future of banking is truly dependent on how long and how well customer relationships last.

That’s viable growth.

Frequently Asked Questions on Customer Lifetime Value (CLV) in US Banking

1. How is CLV different from traditional growth metrics?

Traditional growth metrics focus primarily on acquiring new customers.

In contrast, Customer Lifetime Value (CLV) emphasizes building long-term

customer relationships and understanding the total value those relationships generate over time.

2. What common mistakes do banks make when measuring CLV?

Banks often make several common mistakes, including:

- Using revenue instead of profit

- Not adapting to changes in credit rates and market conditions

- Ignoring cost-to-serve and potential losses

- Not treating CLV as a decision-making system

3. Why is CLV especially tricky but valuable in US banking?

CLV is particularly complex in the US banking sector because:

- Profitability depends heavily on interest and credit rates

- Compliance costs vary across products and services

- Customer value changes across different lifecycle stages

- Losses and fraud are often uncertain

- Relationship value is not always monetized immediately

4. Why do customers with multiple banking products have higher value?

Customers who use multiple banking products are more engaged,

generate higher revenue, and are more likely to remain loyal,

making them significantly more valuable over time.

Sources:

(i). Banking Industry Report 2025: Key Data & Innovation Insights

(ii). Banking Industry Analysis 2026

(iii). Global Banking Annual Review 2025: Why precision, not heft, defines the future of banking

(iv). Banking Customer Retention Statistics 2025: Global Rates, Digital Impact & Gen Z

(v). Financial Services Top Trends 2025- Retail Banking

(iv). Banking Consumer Study 2025