Introduction

In today’s world, where the economic setup is unpredictable and tumultuous, cash is not just the king or queen; it’s the whole royal court. Maximizing cash flow is vital for every kind of business, whether you are a start-up in Kensington or a big manufacturing company in Glasgow. The flow of cash decides whether you are thriving in the business or struggling.

As per the Research briefing of the House of Commons Library-High cost of living: Impact on households– in 2024, 74% adults in the UK stated about the increased cost of living[i].

But here’s the catch- just keeping a tab on your bank balance is not sufficient. What you need is a holistic overview. And this is the area where measuring KPI (Key Performance Indicators) comes into the picture. KPI are a strategic toolkit to enhance, monitor, and measure the efficiency of collections and the cash flow.

Why Cash Flow & Collections is more necessary than ever

In order to lessen difficulty of the difficulty of business organisations, Prompt Payment Code enforcement measures have been imposed by the government.

However, companies need data and KPIs to get proactive control instead of just wishing that the customers will pay on time.

The Indispensable KPIs Every UK Business Should Monitor

1. Days Sales Outstanding (DSO)

What does this mean – The average number of days it takes your company to collect payment after a sale.

Formula:

DSO = (Accounts Receivable / Total Credit Sales) x Number of Days

Why it matters:

An increase in the DSO indicates that your customers are taking more time to pay. This longer payment time puts unnecessary pressure on the working capital. 30–60-days payment terms are common in the UK; however, it becomes troublesome when it crosses 60.

Credit and Collections Professionals’ data in the Market surveys the average DSOs for several industries in the UK are[iii]

High DSO (60+ days)

- Construction

- Engineering,

- Professional Services

- Travel & Leisure,

- Food & Beverage (manufacturing).

Moderate DSO (40-60 days)

- Healthcare

- Wholesale & Distribution

- Manufacturing

- Technology, Retail.

Low DSO (less than 40 days)

- Utilities

- Public Administration

- Telecommunications

2. Collection Effectiveness Index (CEI)

Measuring the efficiency of the team in collecting receivables in terms of percentage.

Formula:

CEI = (Amount Collected / Amount Collectible) x 100

Why it matters:

CEI presents a factual view of the credit control team’s capabilities in resolving conflicts, bad debts, and payment delays.

As per Wise’s article Accounts Receivable Metrics and KPIs (2025) A CEI that is usually above 80% signifies that the collection system is performing satisfactorily. However, a CEI of 100% depicts that every dollar due was collected on time, though this occurs seldom[iv].

3. Cash Conversion Cycle (CCC)

The total time taken by a business to convert account and capitals into cash flows from sales.

Formula:

CCC = DSO + Days Inventory Outstanding – Days Payable Outstanding

Why it matters:

CCC assists you in comprehending the operational efficiency of your cash flow. An extended CCC in sectors like retail or manufacturing holds up capital and confines growth.

Businesses tend to have shorter cycles, mobilising cash when they have effective supply chains and well-negotiated supplier terms.

4. Aged Debtor Analysis

It is a segregation of overdue invoices by age, like 0-30 days, 31-60 days, etc.

Why it matters:

This KPI enables businesses to recognise the customers with delayed payments, identify trends, and focus on accounts that are high risk to expedite follow-ups.

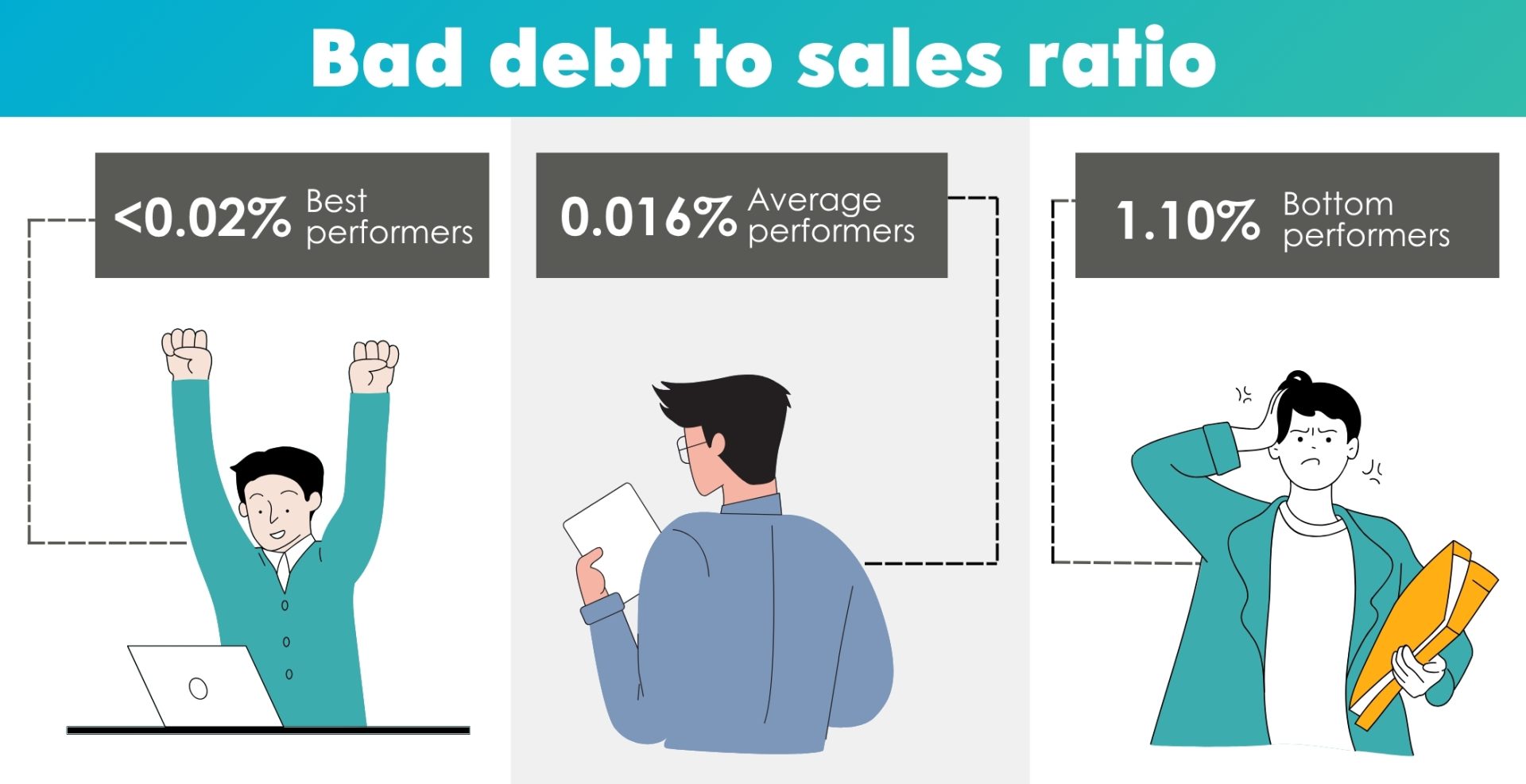

5. Bad Debt to Sales Ratio

It is the sales percentage that your company writes off as bad debt.

Formula:

Bad Debt Ratio = (Bad Debts Written Off / Total Sales) x 100

Why it matters:

A mounting bad debt ratio is a flashing red flag for credit risk and vulnerable customer screening.

6. Operating Cash Flow (OCF)

What it is: Cash created from regular business operations.

Why it matters:

This is one of the prominent identifiers of your business’s financial well-being. No matter your business seems profitable on paper but it’s displaying negative OCF shows that you are in deep water.

As per Faster Capital’s article, Operating Cash Flow Margin: How Operating Cash Flow Margin Impacts Startup Success– Healthy benchmarks & Industry Ranges for Operating Cash Flow for the Capital-intensive sector are 20% to 30%; however, for a start-up, it is 15%[v].

Tools & Tech: How UK Businesses monitor the essential KOI

The traditional web of spreadsheets is now scrapped by Contemporary business houses, and real-time cash flow management tools are adopted.

- Xero & QuickBooks UK editions

- Chaser

- Float

- Fluidly

These tools automate, forecasts, deploys AI to make the tracking method seamless.

Tactical Steps to Advance Collections Success

Here’s how top-performing UK firms are using KPIs to drive action:

- Discounts and loyalty bonuses for on-time payers

- Focussed follow-ups for high-value debtors

- Outsourcing to Debt collections agencies for consistently late accounts

- For faster payment settlements using Open banking.

- Adoption of the Prompt Payment Code to establish trust and reliability

We are living in the age of one click- a click that can make big decisions, thus we can’t wait for the invoices to go overdue and take action beforehand. Issues of inconsistent cash flow are indicators, not root problems.

Final Words:

We are living in the age of one click- a click that can make big decisions, thus we can’t wait for the invoices to go overdue and take action beforehand. Issues of inconsistent cash flow are indicators, not root problems. You can thrive and succeed by tracking the right KPIs and working on them. If you can monitor it, you can work to enhance and manage it well, and that becomes your edge.

Frequently Asked Questions About Cash Flow and Collections KPIs

1. How often should KPIs be reviewed to get a better picture?

Different KPIs have different review time frames:

- Weekly: DSO, aging analysis, promise-to-pay follow-ups

- Monthly: Bad debt ratio, CEI, OCF margin

- Quarterly: Cash flow trends, forecasting accuracy, credit policy reviews

2. Can KPI tracking be enhanced by automation?

Yes. Modern AR platforms help in tracking KPIs with:

- Real-time dashboards

- Automated alerts

- Predictive analytics

- CRM integration for a holistic view

3. How can KPIs help improve cash flow?

Insights from KPIs can help by:

- If DSO increases, make credit terms more stringent

- Target high-risk customers using aged debtor data

- Enhance follow-ups with collection lag indicators

- Identify and remove unprofitable segments using high bad debt ratios

4. Can poor collections impact supplier relationships?

Yes. Poor collections can cause cash flow deficits, making it harder to pay suppliers on time. This can:

- Damage trust

- Cause supply chain disruptions

- Affect pricing and credit terms

Sources :

High cost of living: Impact on households

Two million of Britain’s small businesses fall victim to late payments

Market surveys

Accounts Receivable Metrics and KPIs (2025)

Operating Cash Flow Margin: How Operating Cash Flow Margin Impacts Startup Success